Amazon Demand Side Platform (DSP)

Amazon Demand Side Platform (DSP) represents the next evolution in programmatic advertising, enabling brands to reach audiences across Amazon’s ecosystem and thousands of premium third-party properties.

Unlike traditional keyword-based advertising, DSP leverages Amazon’s unparalleled first-party shopper data to drive full-funnel campaigns spanning awareness, consideration, and conversion stages.

In 2025, Amazon’s advertising revenue reached $17.7 billion in Q3 alone – a remarkable 24% year-over-year increase – with DSP serving as a critical growth engine for this expansion.

Through strategic partnerships with expert agencies like The Boost Social, brands can unlock capabilities once exclusive to Fortune 500 companies, delivering measurable returns while optimizing acquisition costs.

We’ve built this guide for brands and sellers seeking to understand how DSP works, why it differs fundamentally from Sponsored Products, and how to implement a winning strategy.

What Is Amazon Demand-Side Platform?

Amazon Demand Side Platform is a programmatic advertising platform that allows brands to buy display, video, and audio ads both on and off Amazon.

Rather than targeting shoppers based on keywords they’re searching for, DSP targets people based on their demonstrated behaviors: what they’ve browsed, what they’ve purchased, what they’re watching, and which lifestyle categories they fit into.

The platform operates on a cost-per-impression (CPM) model, typically ranging from $5 to $15, versus the pay-per-click (PPC) model of Sponsored Products. This fundamental difference reflects a strategic shift from capturing existing demand to actively creating it.

Core capabilities of Amazon DSP include:

- First-party audience targeting based on Amazon’s billions of shopping signals

- Programmatic ad buying across display, video, and audio formats

- Cross-property reach spanning Amazon.com, Prime Video, Twitch, Amazon Music, and thousands of third-party websites

- Advanced frequency management to prevent audience fatigue

- Real-time bid optimization powered by machine learning algorithms

We recognize that Amazon Demand Side Platform’s real power lies in its data advantage.

Amazon captures shopping behavior from 61% of U.S. product searches, providing a granular understanding of customer intent that keyword targeting alone cannot match.

This data fuels sophisticated audience segmentation and lookalike modeling, enabling precision we didn’t have before.

DSP vs. Sponsored Ads

The difference between DSP and Sponsored Products isn’t merely tactical—it’s strategic. These platforms serve fundamentally different purposes in a brand’s marketing architecture.

Sponsored Products and Sponsored Brands are reactive tools. They capture shoppers actively searching for solutions. When someone types “running shoes” into Amazon’s search bar, Sponsored Ads compete for that high-intent moment. They excel at conversions because the customer has already signaled explicit demand.

Amazon DSP, by contrast, is proactive. It reaches audiences before they begin searching. We use DSP to introduce your brand to potential customers, build affinity through storytelling, and guide them toward purchase across multiple touchpoints. A runner browsing fitness content on Twitch encounters your brand through a DSP video ad. Days later, while scrolling news sites, a display ad reinforces your value proposition. When they finally search for running shoes on Amazon, your brand is top of mind.

This complementary relationship means sophisticated brands run both simultaneously. Sponsored Ads capture the final customer at peak intent. DSP fills the funnel with future customers. Together, they create compounding returns. DSP campaigns generate sales velocity signals that boost organic rankings, thereby reducing the CPC required to win searches.

Key differences in practice:

| Dimension | Sponsored Ads (PPC) | Amazon DSP |

|---|---|---|

| Targeting Logic | Keywords + search intent | Audience behavior + demographics |

| Primary Goal | Immediate conversion | Full-funnel demand creation |

| Reach | Amazon.com only | Amazon + 3rd-party inventory |

| Pricing | Pay-per-click (~$1.12 avg) | Cost-per-impression ($5-15 CPM) |

| Measurement | Last-click attribution | Multi-touch attribution (via AMC) |

| Creative Format | Text ads + product listings | Display, video, audio, CTV |

The Data Advantage Using Amazon’s First-Party Intelligence

The competitive moat protecting Amazon’s Demand Side Platform is data.

Unlike Google, Facebook, or other platforms relying on third-party cookies or inferred behavior, Amazon’s data is verified behavior—actual purchases, actual browsing, actual searches across a retail ecosystem.

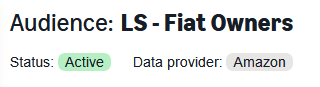

We access granular audience signals, including:

- Purchase history: Products customers have bought, price ranges they spend, categories they favor

- Shopping behavior: Browsing patterns, items added to carts but abandoned, frequency of repurchasing

- In-market segments: Real-time signals indicating customers considering purchases in specific categories

- Lifestyle audiences: Aggregated behavior indicating specific life stages (new parents, eco-conscious consumers, fitness enthusiasts)

- Lookalike modeling: Millions of shoppers matching the profile of your best customers

- Device and platform data: Cross-device behavior showing how customers research and purchase across screens

This data advantage compounds. As we optimize campaigns, we refine audience definitions, improving targeting precision, lowering costs, and increasing ROAS. Each iteration makes future campaigns more effective.

Dejan Skeledzija, Senior Strategist at The Boost Social, emphasizes this point: precision audience work early produces exponential returns.

Rather than broad prospecting, we start by identifying your most valuable customer profiles, layering Amazon’s data to find millions of similar shoppers, then progressively testing and refining.

The Architecture of a Winning DSP Strategy

We’ve learned that successful DSP campaigns require systematic thinking across three strategic layers: strategy, execution, and measurement.

Define Campaign Objectives

Clarity of purpose determines everything downstream. We begin by defining what success looks like at the campaign level. Is this campaign’s job to build awareness? Drive consideration? Recover abandoned carts? Acquire new-to-brand customers? Close existing high-intent shoppers?

Each objective demands different targeting, creative, placement, and measurement strategies. A campaign optimized for awareness, as we judge it by immediate ROAS, will appear to fail. A conversion-focused campaign measured by reach metrics will mislead.

We typically structure accounts with three campaign tiers:

Awareness Tier

Broad reach campaigns using lifestyle and demographic targeting, often leveraging Prime Video and streaming placements. We measure success through reach metrics, video completion rates, and view-through conversions. Budget allocation: 25-40% of DSP spend.

Consideration Tier

In-market audience targeting combined with light retargeting. We place display and video ads in front of shoppers actively browsing your category. Measurement focuses on detail page views, add-to-cart rates, and cost-per-detail-page-view. Budget allocation: 35-40% of DSP spend.

Conversion Tier

Heavy retargeting of past website visitors, product viewers, and cart abandoners. We prioritize Amazon-owned placements and competitor conquesting. ROAS and cost-per-acquisition drive decisions here. Budget allocation: 20-25% of DSP spend.

Campaign Architecture

We’ve found that solid execution requires disciplined audience management, creative strategy, and continuous optimization.

Audience Management: We start broad, then refine as data accumulates. Week one might include all shoppers who purchased in your category within the past 180 days. By week three, we’ve identified which sub-segments convert profitably, allowing us to increase budget for high performers and pause drains. We layer audiences strategically, combining in-market segments with demographic filters, for example, rather than over-segmenting from the start.

Creative Strategy: Amazon’s platform rewards creative diversity. We always test 3-5 creative variations simultaneously, covering different messaging angles, aspect ratios, and video lengths. Short-form video (15-30 seconds) typically outperforms long-form on streaming placements. Static display ads perform well on third-party sites. Dynamic product ads, which automatically update based on inventory and pricing, deliver strong retargeting performance.

Importantly, we rotate creative every 2-4 weeks. The best creative in week one loses effectiveness by week five due to audience fatigue. Fresh creative prevents CTR decline and maintains conversion efficiency.

Frequency Management: Overexposure kills campaigns. We implement frequency caps limiting how many times a single user sees your ad within a rolling week. For awareness campaigns, we cap frequency at 4-5 impressions per user per week. For retargeting, we’re more aggressive (7-10 impressions) because users expect to see ads for products they’ve already interacted with. Beyond frequency caps, we monitor actual frequency metrics and increase creative rotation if we detect performance degradation.

Measurement Layer From Data to Decisions

This is where agencies like The Boost Social differentiate. Campaign data means nothing without sophisticated interpretation.

Primary Metrics by Campaign Type:

- Awareness: Reach, frequency, video completion rate, impressions (avoid judging by ROAS)

- Consideration: Detail page view rate, add-to-cart rate, cost-per-detail-page-view, click-through rate

- Conversion: ROAS, cost-per-conversion, new-to-brand conversions, return customer reactivation rate

We use Amazon Marketing Cloud (AMC) to move beyond last-click attribution. AMC allows us to see the entire path to purchase, including how many times a customer saw your DSP ad before they clicked on a Sponsored Ad to purchase.

This multi-touch view shows that a campaign that appeared unprofitable on a last-click basis actually drove significant value by warming up audiences for your PPC campaigns.

Dejan Skeledzija works within AMC to build custom dashboards for clients, providing transparency into which audience segments, placements, and creatives drive profitable returns. This level of granularity eliminates guesswork from budget allocation.

Performance Benchmarks and Real-World Results

We’ve analyzed dozens of case studies and client data. Here’s what we observe in 2025:

Financial Performance:

- Average CPM ranges from $5-15, depending on placement quality and inventory type

- Successful campaigns achieve ROAS between 5x and 25x, with 10-15x being a solid middle ground

- Cost-per-acquisition typically runs 25-40% lower on DSP than Sponsored Products, due to precise audience targeting

- New-to-brand customer acquisition costs average $15-35, depending on category competition

Efficiency Metrics:

- Click-through rate on DSP display ads averages 0.3-0.8%, with top performers exceeding 1%

- Video completion rates on Amazon-owned properties (Prime Video, Fire TV) run 50-70%, significantly outperforming third-party inventory

- Conversion rates on Amazon average 11.1%, compared to 1.33% for non-Amazon ecommerce sites, an 8.4x advantage

Scale Indicators:

- Brands using multi-channel Amazon advertising (DSP + Sponsored Products + Sponsored Brands) see 13.2x higher awareness lift compared to single-channel approaches

- Video campaigns leveraging Amazon properties drive 44% higher incremental reach

A recent case study illustrates typical results: a DTC brand with $2M in annual revenue allocated $12,000 per month to DSP.

Within 60 days, they achieved an 8:1 ROAS on the DSP campaigns. More significantly, their Sponsored Products campaigns saw a 22% decrease in CPC, as improved brand awareness reduced the keyword bids needed to win placements. Indirect lift brought total incremental revenue to $187,000 over six months.

Common Pitfalls with Amazon Demand Side Platform and How We Avoid Them

Experience has taught us where brands stumble:

Pitfall 1: Expecting Immediate ROAS from Awareness Campaigns

By definition, awareness campaigns reach users early in their journey. Many won’t convert for weeks or months. Yet brands often kill awareness campaigns after 14 days of “poor” ROAS. We prevent this by establishing awareness-specific KPIs at launch and protecting awareness budgets from conversion-focused scrutiny.

Pitfall 2: Over-Segmentation Without Data

New clients often want to segment audiences into dozens of micro-segments from day one. Without conversion data, these guesses waste budget. We start with 4-6 broad audience groups, gather performance data for 7-14 days, then progressively refine based on actual results.

Pitfall 3: Single Creative Across All Placements

A video that performs brilliantly on Prime Video may flop on Twitch due to audience context and the content environment. We always create placement-specific creative: longer narrative videos for streaming, punchy videos for social apps, static banners for web, and audio-optimized ad copy for audio placements.

Pitfall 4: Ignoring Attribution Complexity

Many brands run DSP while also running Sponsored Products, assuming they’re independent. Actually, they interact continuously. Without AMC-level attribution, you can’t see that DSP campaigns are warming up audiences for cheaper PPC conversions. This leads to defunding DSP, even though it’s actually highly profitable when measured correctly.

Pitfall 5: Hands-Off Campaign Management

DSP requires active stewardship. Bidding strategies, frequency caps, creative rotation, audience refinement—these need weekly attention at a minimum. We’ve seen agencies run “set it and forget it” DSP campaigns that hemorrhage budget. We maintain daily dashboards tracking performance and weekly optimization cycles.

Dejan Skeledzija, The Boost Social Agency and Why Specialized Expertise Matters

The complexity of DSP explains why specialized agencies exist.

Running DSP effectively requires a skill set uncommon in the broader marketing industry: understanding of programmatic bidding, fluency with Amazon’s unique data architecture, proficiency with AMC, and the discipline to test and iterate systematically.

Dejan Skeledzija at The Boost Social brings this expertise from thousands of hours managing DSP campaigns across dozens of industries and brand sizes. His approach reflects several distinctive principles:

Data-First Mentality: Before touching the platform, Dejan analyzes your historical performance data. Which customer cohorts have the highest lifetime value?

Which products have the strongest organic velocity? Which geographies show the strongest demand signals?

This analysis informs audience targeting and creative strategy. Most agencies skip this step and launch campaigns based on guesses.

Full-Funnel Coordination: DSP doesn’t exist in isolation. Dejan coordinates DSP strategy with your Sponsored Products campaigns, ensuring complementary rather than competitive positioning. Sponsored Products target high-intent keywords. DSP builds awareness and drives organic lift. When properly integrated, they generate compounding returns.

Weekly Optimization Discipline: The Boost Social maintains weekly optimization cycles. Each week, we analyze performance across audience segments, audit creative performance, adjust frequency caps, test new audience combinations, and refine bidding. This discipline compounds—small gains across 52 weeks add up to dramatic performance improvements.

Transparent Reporting: We provide access to custom dashboards that show exactly how your DSP budget is allocated across audiences, placements, and creatives. You see not just top-level ROAS but granular performance by segment. This transparency prevents “black box” advertising and enables you to understand which strategies generate your returns.

The Boost Social’s client results validate this approach. Clients report average ACOS reductions of 25-40% within 30 days of onboarding, 20%+ revenue growth with reduced spend, and new-to-brand customer acquisition at profitable scale.

Practical FAQ: Questions We Hear Frequently

Q: What’s the minimum budget to start with DSP?

A: Amazon’s self-serve platform requires $35,000+ monthly minimums. However, working with an agency like The Boost Social reduces entry barriers to $5,000-15,000 monthly, allowing smaller brands to access the platform. We recommend starting with $10,000-15,000 monthly for 30-60 days to gather meaningful performance data before scaling.

Q: How long until we see results?

A: This depends on your objective. Retargeting campaigns (cart abandoners, past viewers) show measurable impact within 7-14 days. Consideration campaigns (in-market audiences) typically show clear ROAS signals within 14-30 days. Awareness campaigns that build brand equity may take 60-90 days to fully measure impact through lift studies and incremental revenue. We recommend patience and clear KPI definitions matched to campaign objectives.

Q: Can DSP work for small sellers?

A: Yes, absolutely. DSP excels for brands generating $500,000+ in annual revenue, where the required monthly budget ($10k-15k) represents a reasonable media spend. Smaller brands can participate through agency partnerships. The competitive advantage comes from precision audience targeting, not scale—a $5,000 DSP budget targeting your perfect customer cohort often outperforms a $20,000 budget with poor targeting.

Q: How does DSP integrate with our existing Amazon advertising?

A: DSP operates alongside Sponsored Products and Sponsored Brands, filling different roles in your funnel. Sponsored Products capture high-intent search traffic. DSP builds awareness and warms audiences for cheaper PPC conversions. We coordinate messaging, avoid duplicate ad spend, and use AMC analytics to measure channel interaction.

Q: What’s included in agency management?

A: Full-service DSP management includes campaign strategy development, audience research and segmentation, creative ideation and production, campaign setup and configuration, daily/weekly optimization, comprehensive reporting via custom dashboards, and strategic consultation. The Boost Social also provides AMC analysis for multi-touch attribution insights and coordination with your other Amazon advertising efforts.

Q: How do you measure ROI if customers purchase weeks after seeing an ad?

A: This is where AMC and multi-touch attribution shine. AMC allows us to track customers from initial DSP exposure through eventual purchase, even if weeks pass. We also use brand lift studies to measure the impact on awareness and consideration. Combined, these give us a complete picture of DSP’s profitability that last-click attribution alone misses.

Conclusion is Clear, DSP is a Strategic Advantage

Amazon Demand Side Platform represents a fundamental evolution in how brands reach and convert customers. Moving beyond keyword-based advertising, DSP leverages first-party data to reach audiences at every stage of their journey—from initial awareness through loyal repurchasing.

The 24% year-over-year growth in Amazon’s advertising revenue reflects this platform’s increasing importance. Brands that master DSP gain competitive advantages unavailable through traditional advertising channels: precision audience targeting, full-funnel reach, premium inventory access, and the ability to build brand equity while driving immediate sales.

Yet DSP’s complexity requires expertise. Success depends on systematic strategy, disciplined execution, and sophisticated measurement. This is why specialized agencies exist and why brands increasingly partner with experts like The Boost Social.

Whether you’re launching a new product, scaling existing success, or competing in a crowded category, DSP offers measurable paths to profitable growth. The combination of Amazon’s unparalleled data, DSP’s flexible technology, and expert agency management creates an advertising engine that generates returns for years.

The time to explore DSP is now. The competitive advantage belongs to brands that move quickly.